inherited annuity tax calculator

Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. The earnings are taxable over the life of the payments.

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

. Tax Rules for Inherited Annuities. Inherited Non-Qualified Annuity Taxes. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

Inherited Non Qualified Annuity Stretch Calculator Whoever inherits this unqualified annuity will only have to pay taxes on the actual income of the annuity if they are. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded. Lump-sum paymentLets imagine your spouse purchased a 1 million-dollar annuity and 500000.

If youre the spouse of the. The marginal tax rate is 25 because the taxable income falls within the 75900 - 153100. Here are descriptions of some of the most common payout schemes.

How taxes are paid on an. So for instance if the annuity has 50000 in gains and 50000 in principal you wont receive the tax-free principal until after youve received all of the gains. Fixed Deferred Annuity Calculator.

2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of. If you are the beneficiary and inherit an annuity the same tax rules apply. Nonqualified Inherited Annuities Only the interest earned will be subject to taxes.

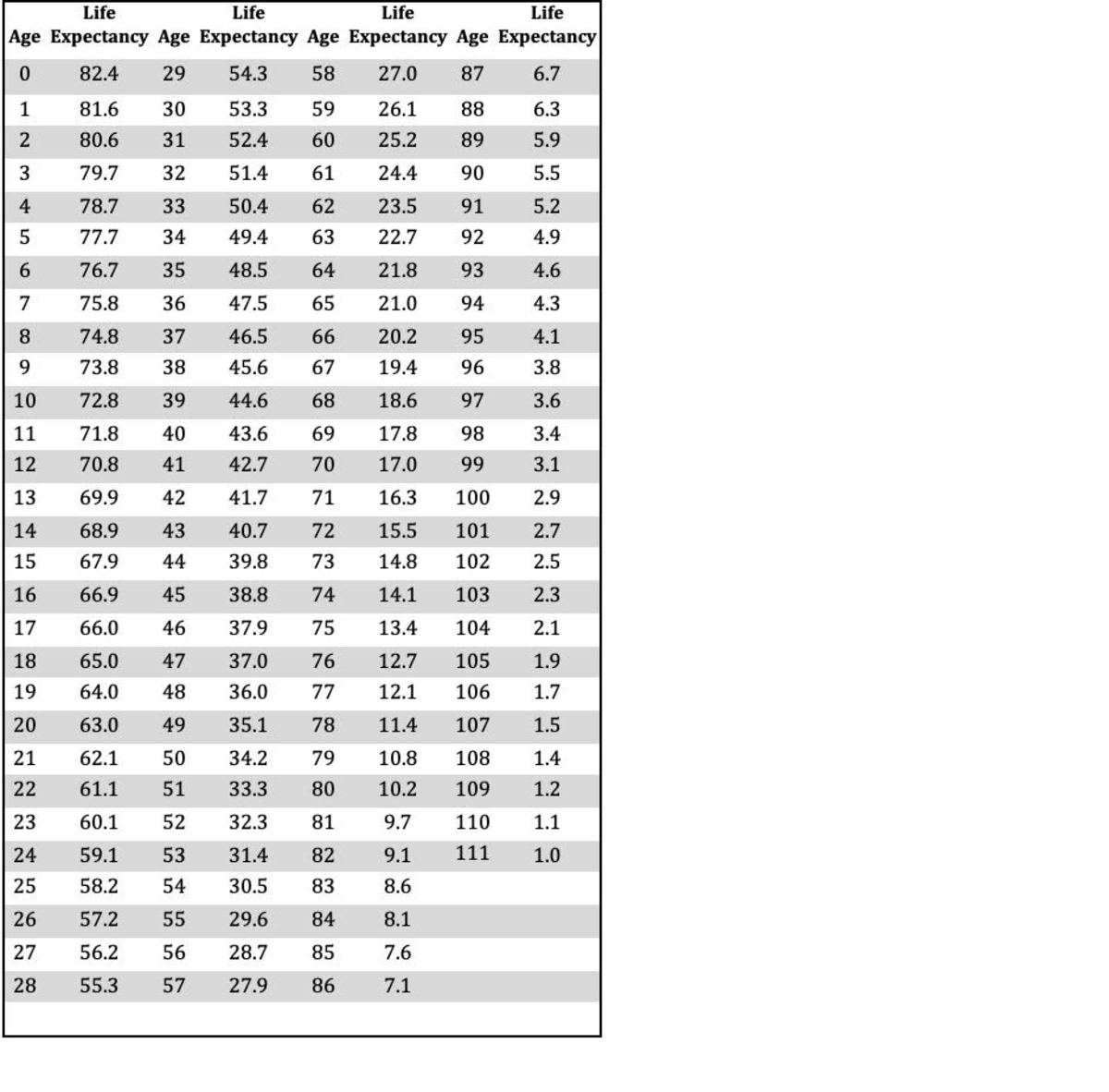

Taxation of an inherited annuity is based on the concept that pre-tax dollars are subject to ordinary income tax while after-tax dollars are exempt. Calculate the required minimum distribution from an inherited IRA. Your estimated tax is the total of your expected income tax self-employment tax and certain other taxes for the year minus your expected credits and withheld tax.

An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. The basis is divided pro-rata not income-out-first.

For instance if half the value of the annuity is exchanged for a second annuity the new annuity will take half the cost basis. With non-qualified annuities funds come from post-tax dollars. Dear Allen If you were born before Jan.

This means the money was already taxed before it was put into the annuity. For annuity owners who. If youre a non-spousal beneficiary you may have the option to transfer the.

The annuities would not have an RMD if your father purchased them himself from an insurance company. RMD applies to a traditional IRA or a qualified retirement plan. Interest earned in your annuity compounds tax-free until you begin making withdrawals which means your value can grow at.

Annuities And Taxes Annuity Tax Benefits And Strategies

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

Calculating Present And Future Value Of Annuities

![]()

Inherited Annuity Tax Guide For Beneficiaries

Making Annuity Inheritances More Tax Efficient

Tax Calculator Estimate Your Income Tax For 2022 Free

Annuity Beneficiaries Inheriting An Annuity After Death

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

How Are Annuities Taxed In Retirement How To Reduce Taxes

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Confused By The New Secure Act S 10 Year Rule For Inherited Iras

Understanding How Taxation Of Annuities Can Impact You Farm Bureau Financial Services

Annuity Beneficiary Learn Payout Structure Death Benefits More

I Inherited Annuities From My Dad How Can I Avoid Being Double Taxed Marketwatch

Does The Inheritance Of An Annuity Affect Social Security Payments

What Is The Tax Rate On An Inherited Annuity Smartasset

Inherited Annuities What Are My Options 2022

What Is The Best Thing To Do With An Inherited Annuity Due

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More